PhD Research Into Integrated Approach to Taxation Optimisation in Latvia

The tax system is one of the crucial elements affecting the viability of the state. Alexey Leontyev, a PhD candidate at Rīga Stradiņš University (RSU) is proposing an integrated approach to the taxation optimisation in his research.

It should be noted that economic science does not have answers to all questions – just like doctors are as yet still unable to treat all diseases. However, both medicine and economics continue to improve steadily.

In order to provide citizens with public goods and services, including health services, the state has to spend the budget and take care to fill it in advance. An insufficient dose of medicine will not give the desired effect, and an excessive dose can kill a patient. This metaphor works with taxes as well. If there are insufficient taxes, the budget will not be filled to the required amount, and if taxes are too high, then it will become unprofitable for enterprises to work, and they might cease their activity or move to be under the jurisdiction of another country where the tax burden is smaller. When treating a patient, a doctor must consider many factors to minimise side effects and not harm their patient. Thus, while improving the tax system, it is impossible to influence any discrete parameter without considering its impact on the entire system.

That is why Leontyev proposes an integrated approach to taxation optimisation in his doctoral these, which should be implemented using the tools created by the author.

The author considers approaches to taxation from the point of view of both the state and businesses. This makes it possible for him to take both parties’ often-conflicting interests into consideration in order to find the right trade-off.

A set of tools was proposed and developed for the integrated approach. These include a tool for assessing the reliability of the tax system and tax reforms, the tax prism method, tools for obtaining a rational solution in multi-criteria analysis, tax system representation as a composite system, and classical methods of statistical and econometrical analysis.

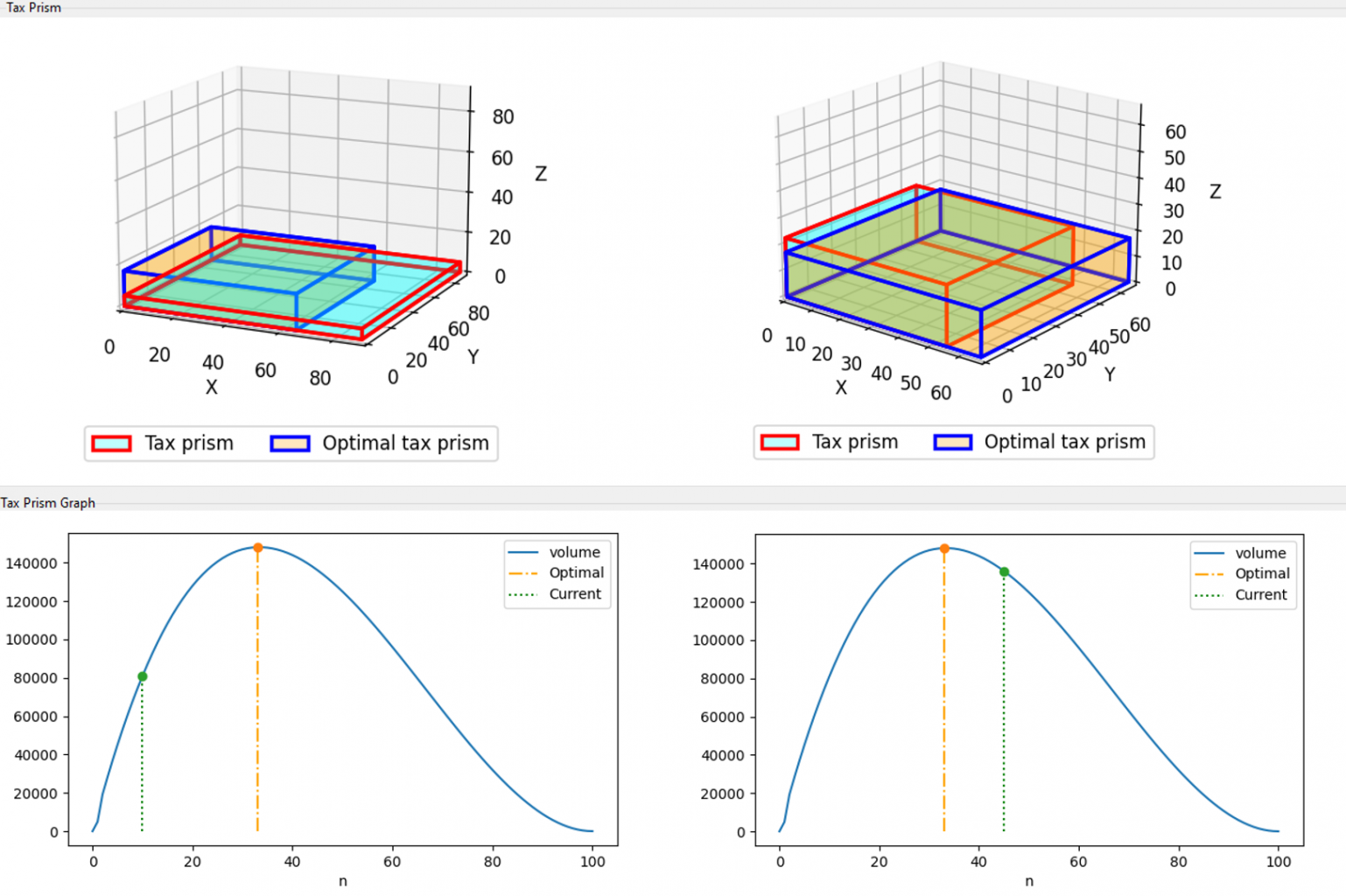

One of these tools is the tax prism which is a replacement for the Laffer curve and has no analogues so far, allowing to assess the relationship between the volume of tax revenues, the tax rate, and the tax base.

The tax prism approach provides greater flexibility for graphical and analytical analysis, considers the three parameters explicitly, and makes it easier to determine the position compared to the inflexion point.

Tax prism visualisation. Image from Alexey Leontyev's dissertation thesis

The implementation of the proposals and recommendations made by the author will improve the reliability of the developed tax reforms and other adjustments made to the state’s tax system. This approach will increase the efficiency of the functioning of the tax system and its balance, and at the same time, will make it possible to consider the interests of the state and the taxpayer more fully, which is especially important in the context of economic instability and the continuing pandemic.

Supervisor: Professor Kārlis Ketners, Director of the Budget Policy Development Department Ministry of Finance, Member of RSU Council.

Alexey Leontyev will defend his doctoral thesis "Integrated Approach to Taxation Optimisation in Latvia" on 10 January 2023.

Further information