PhD student Oļegs Černiševs to defend dissertation on innovative KPI strategies for financial institutions in the fintech era

On 8 July, Oļegs Černiševs will defend his doctoral thesis in economics and business, Regional Dimension in European Union: Shaping Key Performance Indicators for Financial Institutions.

Černiševs' thesis explores the selection and implementation of key performance indicators (KPIs), performance metrics that financial institutions within the European Union (EU), focusing on the integration of its risks. This study aims to address the evolving needs of financial technology (fintech), which is rapidly transforming traditional financial landscapes, and modern financial supervisors' requests for risk-based management approaches.

Background and Objectives

Fintech is changing the financial industry, and banks and other financial institutions need to adapt to different regional economies, rules, and what consumers want.

The European Commission is trying to help by introducing projects like the Digital Financial Platform and the second Payment Services Directive (PSD2). These initiatives are designed to encourage innovation and create a unified digital financial market. However, they also bring challenges, especially in matching KPIs with the associated risks and making sure that there are strong cybersecurity measures are in place.

Key Findings

The study reveals several important findings about the governance and operation of financial institutions in the fintech era. First, it shows that using risk-based KPIs is crucial for effective governance. Traditional KPIs, like Return on Equity (ROE), don't adequately address the specific needs of fintech. Second, the research underscores the influence of regional policies on fintech operations, suggesting that financial institutions can perform better by operating in regions with favourable regulatory environments.

Additionally, the study develops a detailed taxonomy of digital products and a classification system for electronic money and crypto assets. These tools help financial institutions manage compliance risks and streamline their digital offerings. The findings also highlight the importance of complying with regional legislation and implementing tailored risk management strategies to address cybersecurity, operational risks, and financial crime.

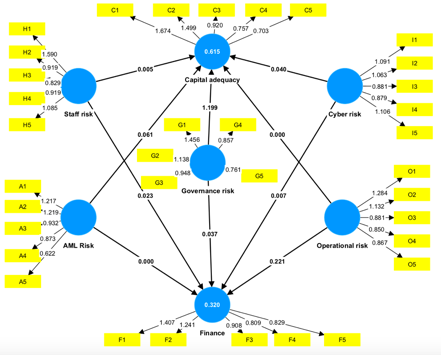

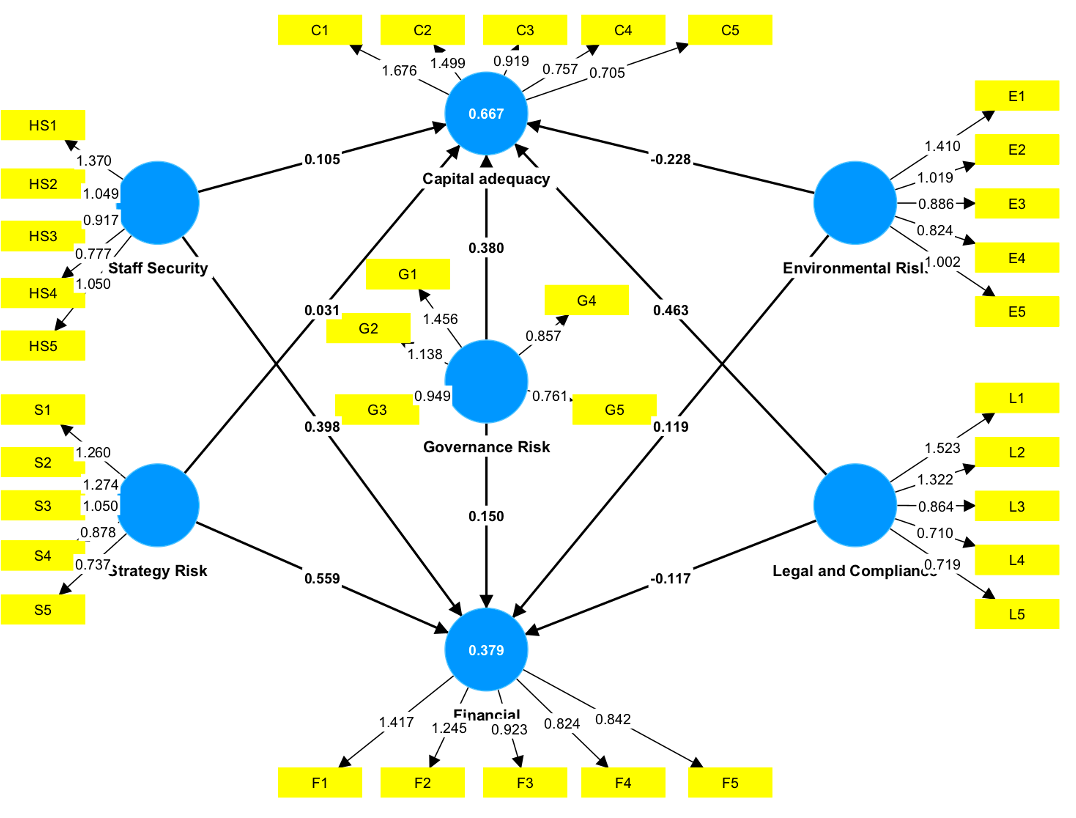

Finally, the research proposes innovative models for assessing fintech risks, showing how both internal and external threats affect financial performance. These models provide a comprehensive view of risks, which aids in better decision-making and strategic planning.

Operational risks model for internal processes

Compliance-related risks model

Practical Significance

Using risk-based KPIs along with traditional metrics helps financial institutions make better decisions and control risks more effectively.

The new classifications and taxonomies make it easier to manage compliance risks and improve financial reporting accuracy. Insights into regional trends and regulations help institutions choose the best locations for their operations, aligning better with EU directives and promoting a safer and more efficient digital economy.

This research addresses shortcomings in current KPI selection methods and offers innovative solutions. It makes a significant contribution to financial governance in the digital age, helping institutions navigate the complexities of the fintech landscape more effectively.